Most companies have been hit hard by the COVID-19 health crisis and it’s turning into a nasty economic crisis too. However, once countries start gaining control over the health situation it’s time to focus on regaining the shareholder value we lost to the virus. This is not going to be an easy task and you’ll see finance professionals across the world being asked to get involved in this.

How do you come up with these ideas though? How do you ensure they’ll positively impact shareholder value? And how do you gain buy-in and acceptance for your ideas so that they lead to a favourable decision? Let’s look closer at this in this week’s episode of “Crisis Management for Finance Professionals”.

Where will ideas come from and what impact will they have?

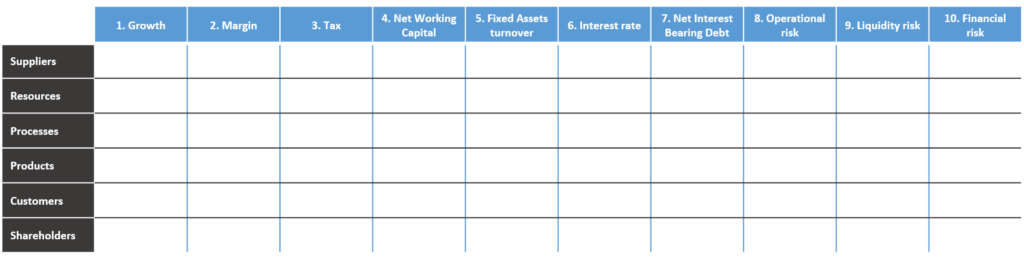

You might think this is going to be a complex exercise but all I’ll be asking you to do is to fill out a 6X10 matrix and you’ll have at least ten improvement ideas in no time! What’s that matrix? It’s the combination of your value chain and the ten value drivers we describe in the book “Create Value as a Finance Business Partner”. Here’s how it looks.

Each box represents an opportunity to regain shareholder value and as finance professionals, you play a key role in making this happen. There’s the direct way where you’re in control of initiatives such as tax, debt, and some of the risk elements. Then there’s the indirect way where you partner with business stakeholders to make better decisions on e.g. growth, cost reductions, or operational risk. Imagine what a simple brainstorm in your team could bring out of ideas!

I’m going to help you get started by providing 30 concrete ideas to what you could do. Of course, they’ll be somewhat generic in nature since I can’t tailor them to your specific business. Still, many of them should be directly transferrable to your situation and as such be a good inspiration for you to start regaining lost shareholder value.

Growth

1. Perform time to market analysis and see if you can shorten your product lead time by taking them digital

2. Product portfolio review to cut the tale by increasing prices or increase prices in general where elasticity is low

3. Take an opportunistic approach to the impact of the crisis and direct your attention to countries or areas that are less severely impacted or look to open for business sooner than others

Margins

4. Benchmark product and customer profitability across your portfolio and understand the root causes behind significant variations

5. Be bold and brainstorm for ideas that could significantly reduce costs (you might not go for them in full but even modified versions can bring significant benefits)

6. Perform a total cost of ownership analysis on your assets – perhaps it’s better to lease than to own to improve your cash flow situation

Tax

7. Perform an analysis of how you ensure to get tax benefits from the losses you’re occurring during the crisis

8. If you’re a multinational company review your company structure to see you have an optimal setup from a tax perspective

9. Go through your internal agreement setup to understand if it caters well to current day’s trade flows

Net Working Capital

10. Review contracts to optimize (or fully utilize) payment terms

11. Better stock utilization through reducing overstocking of non-critical items

12. Stronger debtor management considering all companies are in distress and the certainty of your incoming cash flows might have decreased

Fixed Assets Turnover

13. Conduct an analysis to understand if you should be making your own products (or all the parts in them) or if you could be buying more from suppliers?

14. Optimize your production so you increase the utilization of existing assets

15. Review your business case process to understand how to bridge the gap between planned ROI and actual ROI on asset investments

Interest rate

16. Despite the crisis leading to higher interest rates at least in the short term then you can review your setup of continuous optimization of getting the lowest interest rates i.e. are your rates fixed for longer periods or do you take advantage of every time it goes lower

17. Review how you’re placing excess funds (assuming you have any) considering you could be paying money both to borrow and even to deposit them in the bank

18. Stay on top of your bank covenants as you could easily run into troubles and end up breaching them during these troubled times

Net Interest Bearing Debt

19. Investigate if you can push some of your financing needs to vendors for instance through leasing

20. Consider if you should sell off some of your receivables to limit the risk of defaulting customers due to the crisis

21. Consider suspending your current dividend policy for a year or two

Operational risk

22. Review your sourcing strategy and ensure you’re not too dependent on just a few vendors in case they don’t make it well through the crisis

23. Reflect on how your strategy faired through the crisis and see if it needs adjustments

24. It’s difficult to protect yourself against black swan events but scrutinize heavily how you responded to this health crisis and see what you can do differently next time to ensure a better outcome

Liquidity risk

25. How close were you to bankruptcy from running out of cash? Review your crisis response to staying liquid

26. Assess if any of your customers could run into liquidity trouble and do the needed to mitigate the impact should it happen

27. Utilize in full the government packages to ensure you don’t die due to a short-term crisis despite having an otherwise sound business model

Financial risk

28. Look at the credit risk profile of your customers – did you learn something new during the crisis that should cause adjustments?

29. Do a market-by-market run-through to understand if their risk profiles have changed and you need to rebalance your geographical portfolio

30. Review how you’re leveraged to understand how many more hits you can absorb before you run out of financing options

Those were 30 ideas to get you started but as said once you get going on your own brainstorm, you’ll easily find a lot more!

Source: Linkedin